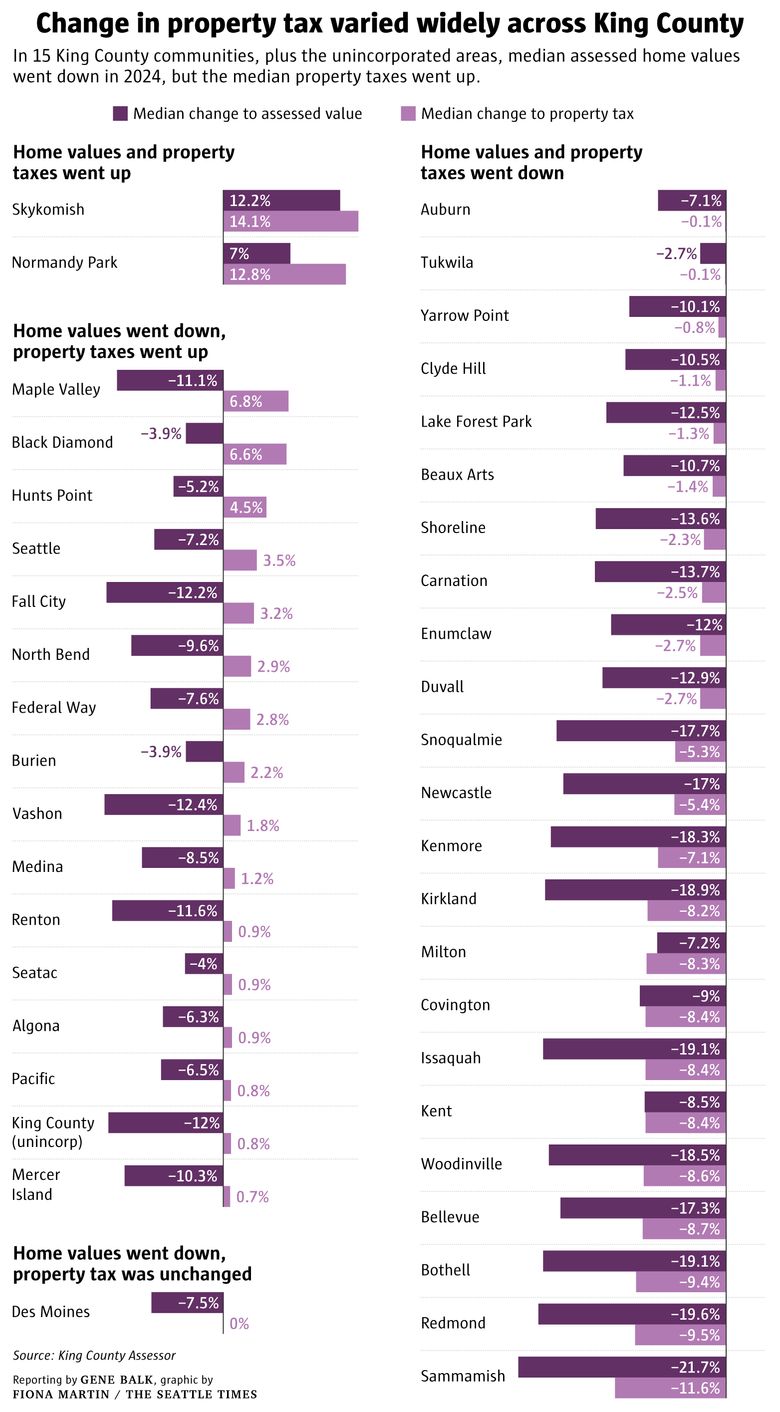

If you’re a King County homeowner, it’s likely your home’s assessed value fell in 2024. Nearly everywhere in the county, assessed values dropped from last year.

But you may be surprised to find your property tax didn’t go down nearly as much as you may have expected. In fact, your taxes may have even gone up as your home’s value declined.

In 15 communities, plus the county’s unincorporated areas, the median assessed home values dropped while the median property tax bill increased, according to data from the King County Assessor’s office.

After my recent column on our high property taxes, I heard from some readers who were disappointed the decline in their home’s assessed value didn’t translate to much of a drop in their tax bill.

One King County homeowner, George Whitehouse, told me in an email the appraised value of his home dropped by $300,000, but his tax bill only dropped by about $600 — less than half what he had hoped. “This is not a sustainable model as more people hit retirement and are forced to sell and move to reduce their overall costs,” Whitehouse said.

Among King County communities, Maple Valley saw the biggest gap between declining values and rising taxes. The median home value fell by $76,000, or around 11%, from 2023 to 2024 while the median property tax increased by around $425, or nearly 7%.

Seattle was also among the communities where values dropped as taxes rose. The median home value fell by $62,000, or about 7%, while the median tax increased by $247, or 3.5%.

The median is the midway point, meaning half are higher and half are lower.

John Wilson, the King County assessor, said his office has also heard from homeowners who feel their taxes should have dropped in line with their home value, and many are confused by how taxes are calculated.

“It’s understandable that most people think if their value went down then their taxes should go down, too,” Wilson said. “But taxes are not tied one-on-one with home values in terms of percentage increase or decrease. [Changes in tax rates] are dependent on what your local jurisdiction voted for.”

Specifically, it’s changes to the mix of voter-approved measures that can have an impact on the tax rate, Wilson said. “Did they have some that rolled off, or did they pass, for example, a school measure?” Wilson said. “Did they have a bond issue that required collecting x amount of money in order to retire those bonds in time?”

The tax rates are calculated manually for each community in the county, and Wilson said that’s a challenge because there are so many variables.

Home values in King County climbed sharply from 2022 to 2023, in what Wilson described as a “superheated” pandemic-era real estate market. This year, values dropped across most of the county as the market cooled down.

Even so, there were two King County communities where the market remained hot and assessed values increased in 2024. In Skykomish, the median home value went up by around 12%, and the median tax bill increased by 14%, which was the largest tax increase in the county. Even with that increase, the median property tax in Skykomish was only around $2,100, the lowest in the county.

In Normandy Park, values were up 7% and taxes jumped by 13%. The median property tax was much higher there than in Skykomish, at around $11,400.

There were 23 King County communities where both the median value and the median property tax declined. But in some, the drop in taxes was minuscule compared to that of home values. For example, in Shoreline and Carnation, the median value fell by almost 14% while the median taxes dropped between 2% and 3%.

Sammamish had the biggest drop in home values at nearly 22%, and taxes were down almost 12%. Des Moines was the only community where the median property tax bill was unchanged from 2023. Home values, though, were down 7.5%.

In raw dollars, Hunt’s Point had the county’s biggest property tax increase, up by $1,655. But I think the folks in Hunt’s Point can afford it. The median home value was nearly $5.9 million, and the median property tax was about $38,000. That was also the highest in the county, with Medina a distant second at around $27,500.

In Seattle, the median home value was $804,000 and the median property tax was close to $7,300.

Wilson said he understands how it feels to see your home values drop and not get much of a reduction in taxes, or even see an increase.

“It makes people anxious, especially in times like this with high inflation, and they think, ‘Don’t I get a break?’” he said.

Wilson said a coalition of county assessors from around Washington went to the Legislature in Olympia with several tax-relief proposals, including one for homeowners.

“Washington is one of the few states that doesn’t have what’s usually called a homestead exemption,” he said. “We wanted to provide a partial [tax] exemption for owner-occupants of homes that are of moderate value.”

The measures didn’t make it through the Legislature, but Wilson said they’ll try again next year.