Everyone knows buying a home in Seattle is incredibly expensive. But keeping it isn’t cheap either.

I’m talking about property taxes. The tax burden for Seattle homeowners is among the highest for any large U.S. city. And along with home values, property taxes in Seattle have skyrocketed over the past decade.

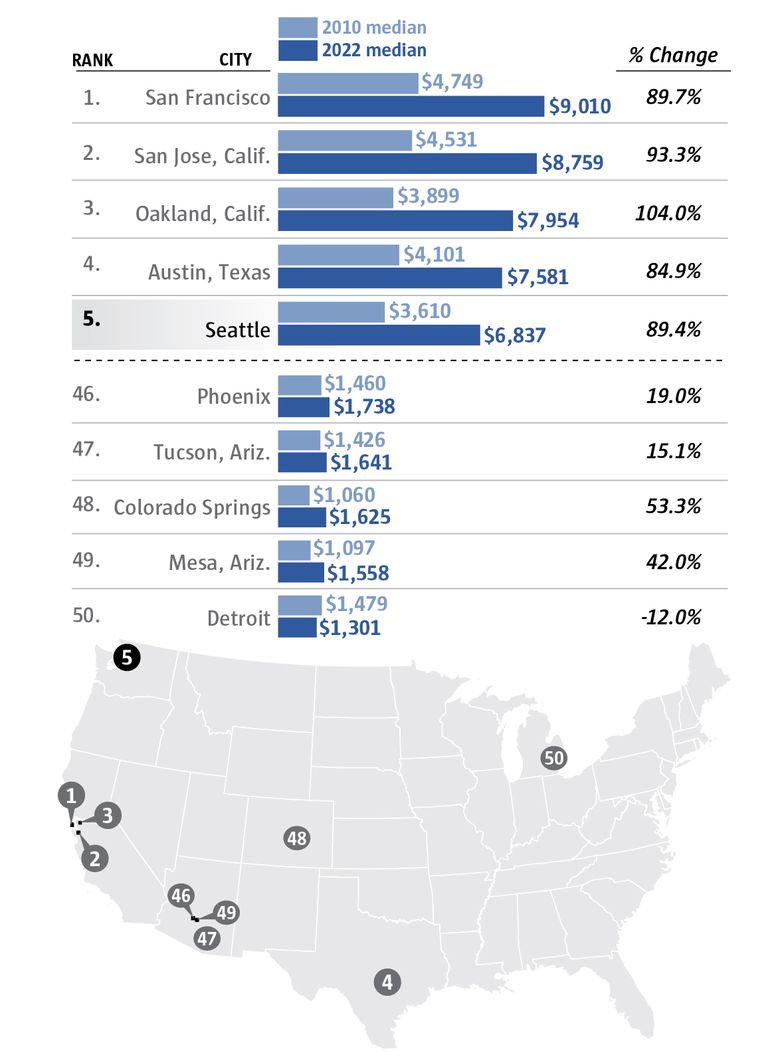

The median amount paid in property taxes by a homeowner in Seattle was more than $6,800 in 2022, according to the most recent census data. Among the 50 most populous U.S. cities, Seattle had the fifth highest median property tax bill. San Francisco was No. 1, at a little more than $9,000, followed by two other Bay Area cities, San Jose and Oakland. Austin, Texas, ranked fourth highest.

The median is the midway point, meaning half of homeowners paid more and half paid less.

In some cities, homeowners pay much less. There were 14 large cities where the typical property tax bill was less than a third of what it is in Seattle. The lowest was in Detroit, at just $1,300. The bottom five also included Colorado Springs and three Arizona cities: Mesa, Tucson and Phoenix.

Of course, cities with high home values like Seattle are often going to have higher property taxes, since the tax is based on assessed value. But that’s not always the case, because the tax rate varies a lot from state to state, and among jurisdictions within each state. According to an analysis by the nonpartisan tax policy nonprofit Tax Foundation, average rates in 2021 ranged from a low of 0.32% in Hawaii to a high of 2.23% in New Jersey. Washington was at 0.87%, which ranked 29th among the 50 states.

Among the 50 largest U.S. cities, Seattle had the fifth-highest median property tax in 2022. From 2010 to 2022, Seattle’s median tax increased by about 89%.

Because of lower local rates, some cities with very high home values — for example, Boston and Washington, D.C. — had median property taxes roughly $2,500 lower than Seattle.

Seattle’s median property tax went up by a whopping 89% from 2010 to 2021. In 2010, the median was about $3,600 — that figure isn’t adjusted for inflation, but even if you did adjust, property taxes in Seattle still rose three times faster than the rate of inflation.

It could be worse — just ask homeowners in California. Among the 50 largest U.S. cities, Seattle ranked seventh for the increase in property taxes behind six cities — all in the Golden State. Oakland was the only major U.S. city where property taxes more than doubled from 2010 to 2022, a 104% increase. San Jose, San Diego, Long Beach, Sacramento and San Francisco also had bigger property tax hikes than Seattle.

“It’s not surprising the top six are all in California,” said John Wilson, King County assessor. “They’ve had both a superheated real estate market plus a scarcity of housing supply which also tends to drive up home values.”

Seattle has a similar scarcity of supply. “The economy is producing far more jobs and far more demand for housing than the amount of housing that we’re building,” he said.

In some big cities, the increases were far more modest. In Las Vegas, Milwaukee and Memphis, Tenn., the median increased by less than 10%. In Detroit, property taxes actually declined by 12%.

Part of the reason property taxes haven’t increased as much in some cities could be that they’re less dependent on them, Wilson said.

“Like Las Vegas probably has a more diversified tax base, and it also probably has a significantly higher commercial base than similar-sized communities,” Wilson said.

Washington state’s constitution limits the regular property tax rate to 1% of a home’s value. But that doesn’t include voter-approved special levies, and some jurisdictions have become increasingly dependent on these levies, including Seattle. That has played a major role in the increase in property taxes.

Washington, of course, does not have a state income tax, which means we’re more reliant on property and sales taxes than most other states.

“A lot of things have been moved out of the general fund budget and into voter-approved funding,” Wilson said. “The general fund number generally doesn’t go down but you’ve put on top of it things like parks and transportation and other things that may have historically been covered in the general fund.”

In November, Seattle voters approved a nearly $1 billion property tax levy for affordable housing.

Among all U.S. cities and places with a population of at least 60,000, there were 13 where the median property tax exceeded $10,000 — 11 of them were in either New Jersey or California.

In Washington, Sammamish wasn’t far behind, with a median property tax bill of nearly $9,700. The city had the biggest increase in assessed values in the state between 2021 and 2022, according to Wilson.

The other Eastside cities with at least 60,000 residents — Bellevue, Redmond and Kirkland — also had higher median property taxes than Seattle.

Outside King County, property taxes were lower, particularly on the other side of the Cascades. Yakima had the lowest median amount, at around $2,400. Kennewick, Pasco and Spokane weren’t much higher.

There is tax relief available for some King County homeowners. If you are 61 or older, disabled or are a veteran with a service-connected disability, and have a household income of $84,000 or less, you could qualify for the county’s property tax exemption program.