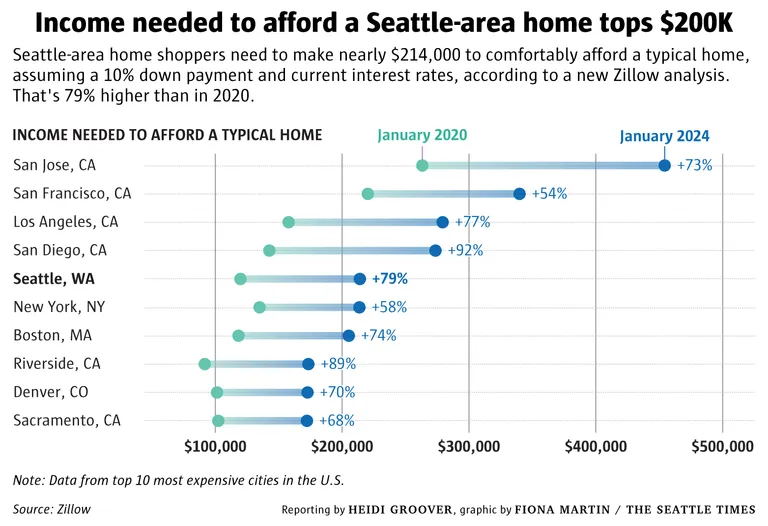

In just a few years, the income needed to afford a typical home in the Seattle area has shot up nearly 80%, illustrating how skyrocketing home prices and interest rate hikes together have reshaped the region’s housing affordability.

A Zillow analysis published Thursday found that Seattle-area home shoppers need to earn nearly $214,000 a year to afford a typical home in the region, the fifth highest income needed among major cities and the highest outside California.

The report assumes buyers spend no more than 30% of their income on housing (a common measure of housing affordability), make a 10% down payment and secure a 6.6% interest rate, the average rate in January.

Mortgage rate increases over the last 18 months drove up the monthly cost of buying a home. At the same time, a shortage of homes for sale kept Seattle-area home prices from plummeting. That combination has throttled the housing market as homebuyers struggle to get in the door.

Since 2020, “affordability has basically halved because the mortgage payment has gone up, but incomes haven’t kept up,” Zillow Senior Economist Orphe Divounguy said in an interview.

Buyers in the Seattle area needed to earn about $120,000 to afford a typical home in 2020, according to Zillow. Even Seattle’s eye-popping $115,000 median household income falls short. While the income needed to afford a home shot up 79% from January 2020 to January 2024, median income in the region increased only about 22%, the analysis found.

Zillow’s conclusion falls in line with others, such as the housing affordability index from the Washington Center for Real Estate Research at the University of Washington. According to that index, homebuyers earning the median income can afford a median-priced home in only two of Washington’s 39 counties, Lincoln and Columbia. The index assumes a 20% down payment and a household spending only 25% of its gross income on mortgage payments.

So, how are homebuyers coping? Many people are spending more than 30% of their income on housing, said Aaron Crossley, a loan officer with Movement Mortgage in Kirkland.

Many Seattle-area homebuyers are spending around 40% of their income on housing and can qualify for a mortgage with a total debt-to-income ratio of 43% to 50%, including other debts, Crossley said.

With higher mortgage rates, “you’re going to have to dedicate a slightly larger portion of your gross income toward housing,” Crossley said.

Some buyers rely on loans or gifts from family members to help cover down payments, though that option is out of reach for many. Black homebuyers in particular are less likely than other buyers to report using a gift from a friend or relative to help with their down payment.

Others are teaming up with friends to afford a home or leaning toward condos, said Seattle Keller Williams agent Sharon O’Mahony. And many are simply waiting longer to buy.

With high prices and rates, even “dual-income couples are struggling to get in right now into the areas they want to be in,” O’Mahony said. “Even with no kids and two incomes, it’s still tough to get into the market.”

On the flip side, buyers succeeding in the current market often have income from investments that have done well, she said.

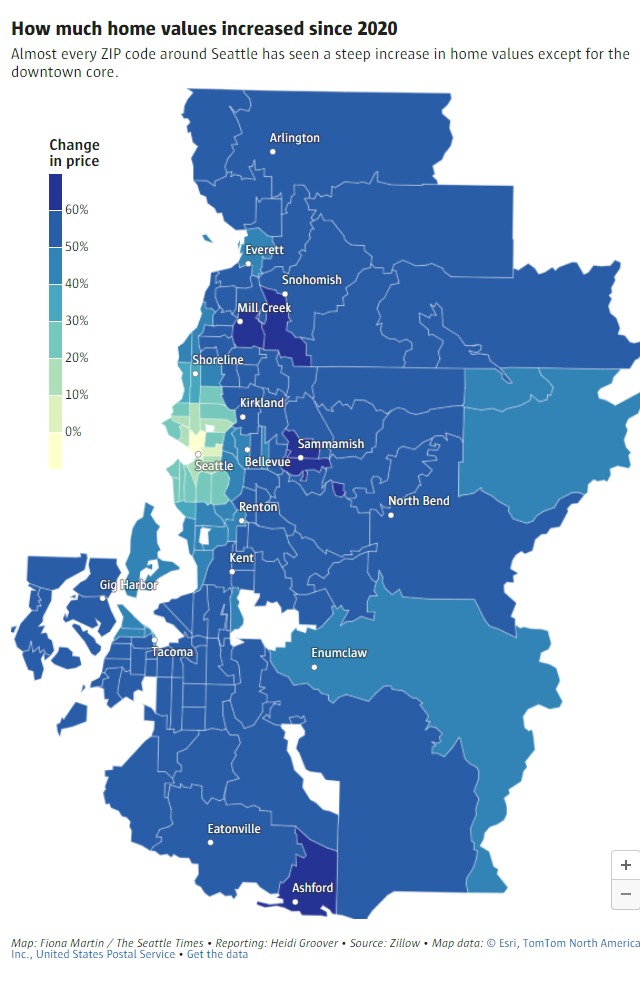

Since 2020, home values have skyrocketed particularly in outlying areas that offer more space and affordability. For example, according to ZIP-code-level data from Zillow, the value of a typical home in a zip code covering Seattle’s Capitol Hill and Central District neighborhoods increased about 8% from 2020 to 2024, compared to 51% in a Renton zip code and 61% in Mill Creek.

For home shoppers, there is little guaranteed relief on the horizon.

(44% in 98198/Des Moines)

Real estate economists expect interest rates to dip some this year, but not to drop dramatically. Few homeowners are listing their properties for sale: “They’re sitting there on these lower rates and then the question is, ‘Even if I sell, where do I move?’” Divounguy said. And homebuilders are dealing with high construction costs and other factors.

“The key, really, to improving affordability is going to have to be builders’ ability to build more homes and help close that gap,” Divounguy said.